35+ Mortgage calculator current balance

Available when you switch to a selected current account using the Current Account Switch Service pay in 1000 set up 2 Direct Debits and log on to Online or Mobile. Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

Contribute To My 401k Or Invest In An After Tax Brokerage Account

Use this auto loan calculator when comparing available rates to estimate what your car loan will really cost.

. Rate adjustment will be applied to current rates. Get 175 cashback when you switch your current account to us. Due to historically low interest rates FRMs are currently far more popular than adjustable-rate loans.

Loan Prepayment Calculator to calculate how much you can save in total interest payments with mortgage prepayment and early payoff. Rates subject to change. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week.

Loan Balance 10 Years. Mortgage loans are originated by Space Coast Credit Union and are subject to credit approval verification and collateral evaluation. Credit card calculators.

RBI hikes repo rate by 50 basis points to 490. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially. Segments of the market can change faster than the overall market due to those same sorts of factors along with various legal changes tied to.

Equity Built 15 Years. Ask your SCCU. Nearly 35 percent of respondents in 2022 said they would need to.

This method also applies to a fixed rate mortgage if the the 3-months of interest total is greater than the total gotten from the calculation described in method 2. This calculator makes it easy to compare the monthly payments for any 2 fixed-rate mortgages FRMs. Mortgage Early Payoff Calculator excel to calculate early mortgage payoff and total interest savings by paying off your mortgage early.

30-year mortgage rates. A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Simply enter the amount you wish to borrow the length of your intended loan vehicle.

Credit Card Calculator Calculate the total cost of a credit card based upon the balance and the minimum payment made. When you remortgage to release equity youre arranging a new deal thats larger than your existing mortgage. 215 Minimum balance to open.

Overall mortgage debt tends to grow around 3 to 6 per annum though there can be significant fluctuations in that rate of growth due to factors like BREXIT the global economic crisis which happened in 2008 COVID-19 lockdowns etc. The difference between your current mortgage balance and the new loan amount is the amount you will receive. Loan Balance 5 Years.

Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 3. Mortgage Prepayment Calculator to calculate early payoff for your mortgage payments based on a desired monthly payment or the number of years until payoff. Credit Card Comparison Calculator Use Our Credit Card Comparison Calculator To Calculate Total Costs and Rate Changes with up to 3 Credit Cards.

Cost of living. Refinancing is the process of changing your current mortgage into better terms with a new loan. This allows you to secure a lower rate change your payment term or both.

Current housing market trends. To help you see current market conditions and find a local lender current Redmond 15-year and current Redmond 30-year mortgage rates are published below the calculator. 3 months 5 years 150 APY 350 APY.

Cost of living comparison calculator. Loan Balance 15 Years. Todays national mortgage rate trends.

Example rates loan amounts and monthy payments shown above are based on current 30-year Conventional Fixed Rate Loan. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but. For breaking a variable rate mortgage contract the penalty is usually 3-months of interest applied to the remaining principal of your mortgage at your currently set interest rate.

For example if you bought a home for 200000 and your mortgage balance is 90000 your home equity is worth 110000. Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms. It also displays the remaining balance of the life of your loan.

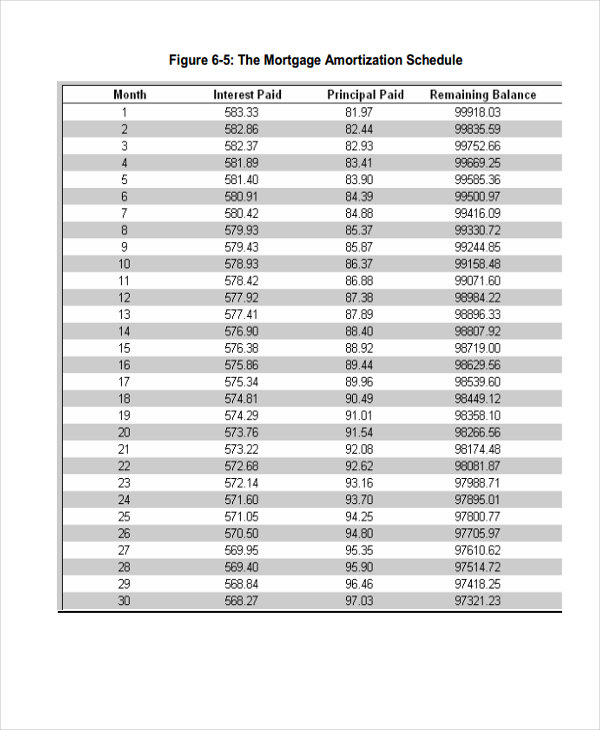

The mortgage early payoff calculator will show you an amortization schedule with the new additional mortgage payment. The remaining 8 represented other types of mortgage products such as 10-year and 20-year fixed-rate loans. Second mortgage types Lump sum.

On widely expected lines the Reserve Bank of India RBI on June 8 2022 increased its short term lending rate the repo rate by 50 basis points as the countrys apex bank tries to bring down inflation from an eight-year-high levelThe six-member monetary policy committee voted unanimously in favour of the rate hike. - TDS is the percentage of your monthly household income that covers your housing costs and any other debts including car payments and. Use the TD mortgage affordability calculator to determine a comfortable mortgage loan and price range for your new home.

Our Canadian Mortgage Calculator allows you to calculate your monthly mortgage payments and cash needed for the purchase of real estate using current lender rates. Second mortgages come in two main forms home equity loans and home equity lines of credit. The end of this term is when the mortgagee can renegotiate a new mortgage or pay the balance of the mortgage in full.

Debt Consolidation Calculator How much can you. Also once the balance on your no-penalty CD hits the minimum balance requirement of 500 you cant add to this CD. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Credit cards. The following table shows current Redmond 30-year mortgage rates. Mortgage loan basics Basic concepts and legal regulation.

It should be at or under 35 of your pre-tax household income. Assuming you have a 20 down payment 50000 your total mortgage on a 250000 home would be 200000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 898 monthly payment. Typically about 35 of home buyers who use financing put at least 20 down.

You can use the menus to select other loan durations alter the loan.

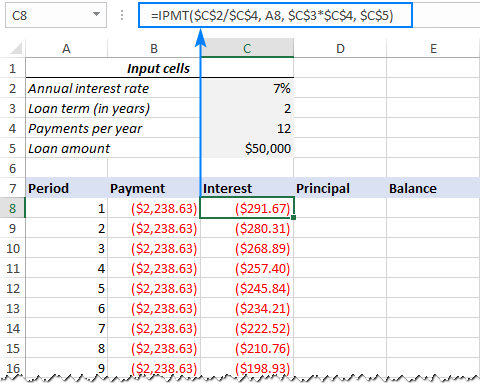

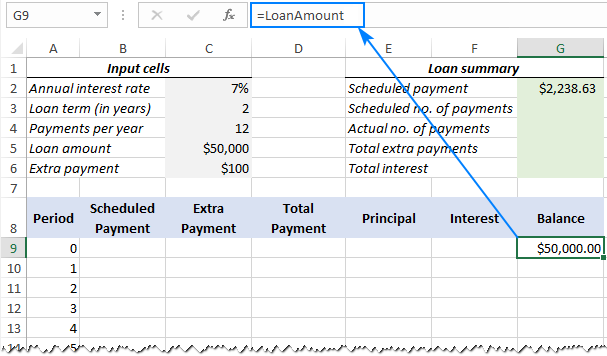

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

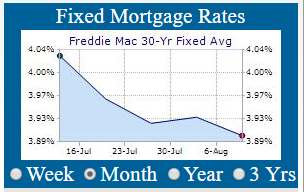

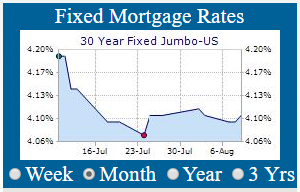

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

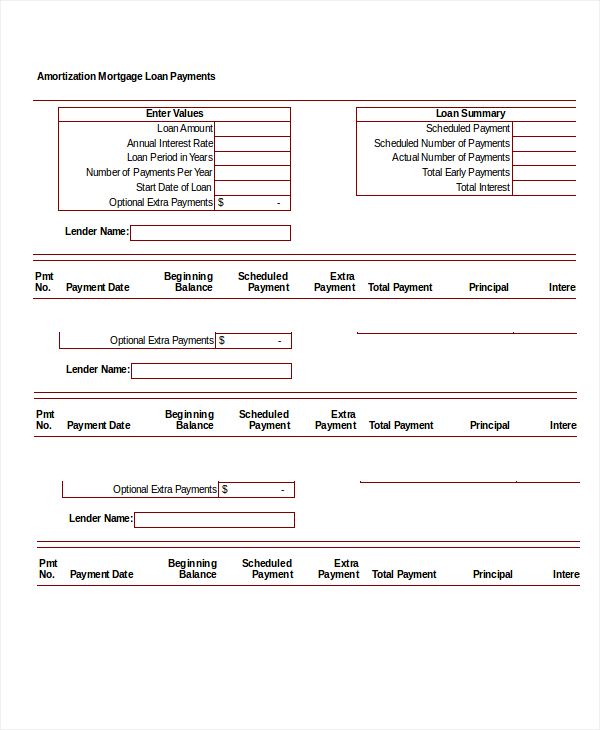

Free Amortization Schedule Free Pdf Excel Documents Download Free Premium Templates

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator

Mortgage Statement 10 Examples Format Pdf Examples

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

29 Amortization Schedule Templates Free Premium Templates

Extra Payment Mortgage Calculator Mortgage Payment Calculator Amortization Schedule Mortgage Calculator

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

How To Calculate The Ending Cash Balance Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed